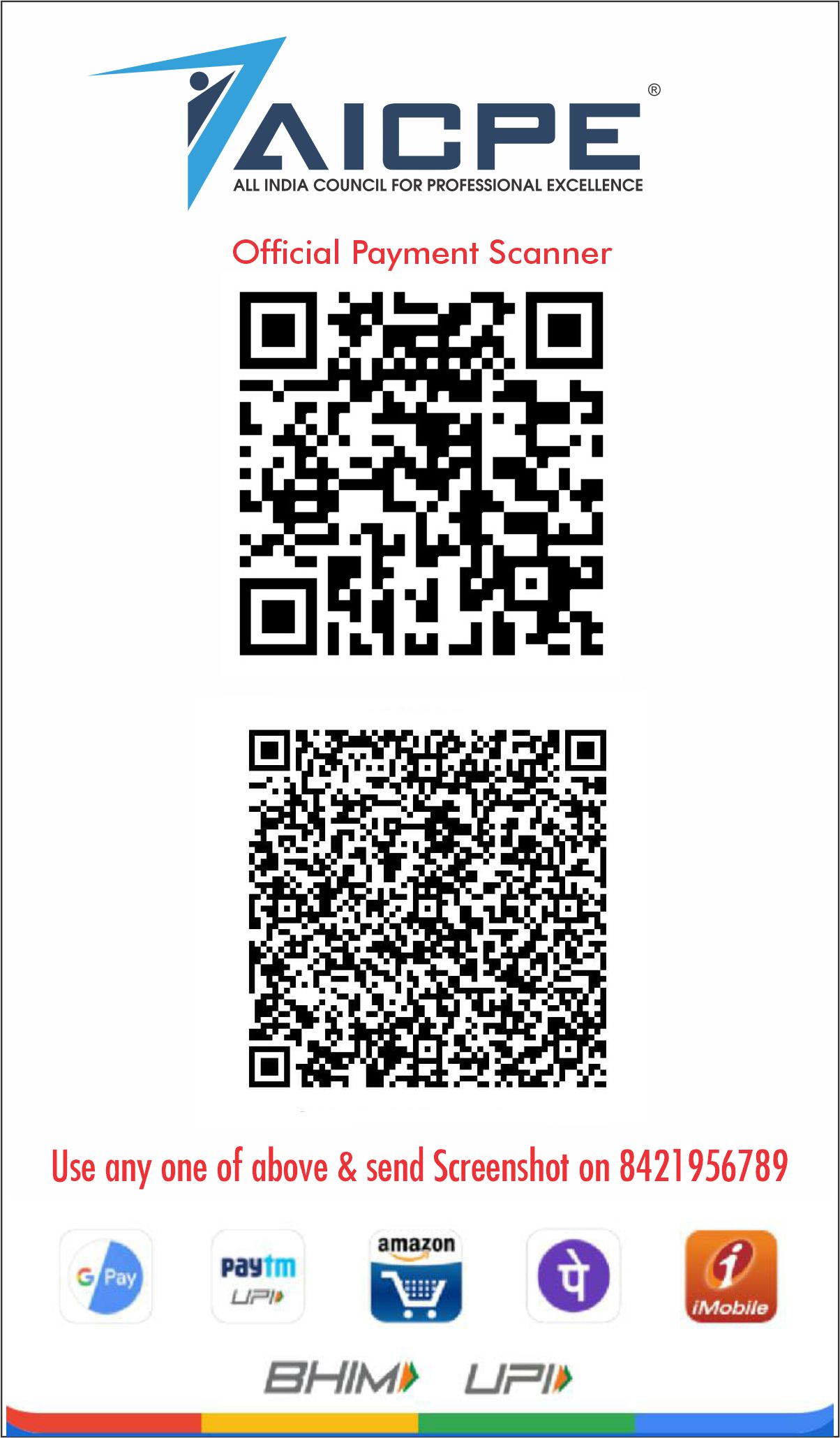

Bank Details

| Account Name |

: |

AICPE EDUCATIONAL SERVICES PVT. LTD. |

| Account No. |

: |

50200031129652 |

| Bank Name |

: |

HDFC Bank |

| Branch |

: |

Shankar Nagar, Nagpur |

| IFSC Code |

: |

HDFC0000102 |

Note : Please DO NOT Deposit amount in CASH or Rs. 100 will be charged Extra as Cash Deposit Charges by Bank